Here are the compelling reasons why Australian Credit Solutions stands out as your preferred choice in the credit management market:

Our confidence in our services is backed by a 'no win no fee' policy. If we are unable to secure a win in your case, we initiate a refund of your fees. Please note that a one-off admin fee of $330 is excluded from this refund policy, but this demonstrates our commitment to providing value and real results for our clients.

We take pride in being the number one award-winning company within our industry. We have a track record of award-winning excellence in 2022, 2023, and 2024. This distinction reflects our unwavering commitment to top-notch service and profound expertise. Each award underscores our credibility and the effective solutions we provide, setting a benchmark for quality and performance in our industry.

Our exceptional services have earned us recognition three times consecutively, emphasizing our commitment to high standards in credit repair and customer satisfaction. Celebrated by Australia's leading review platform, Product Review, we are trusted for our transparent and reliable services. With over 1000 positive client testimonials, our reputation for real results and personalized attention is solidified.

In Australia, all credit repair companies must be licensed under the Australian Securities and Investments Commission (ASIC) and are required to obtain an Australian Credit License (ACL). Australian Credit Solutions proudly holds a valid license, a testament to our legitimacy and adherence to regulatory standards. Our ACL number which is 532003 further establishes our credibility, ensuring that clients can trust us with their credit repair needs, knowing they are in professional and compliant hands.

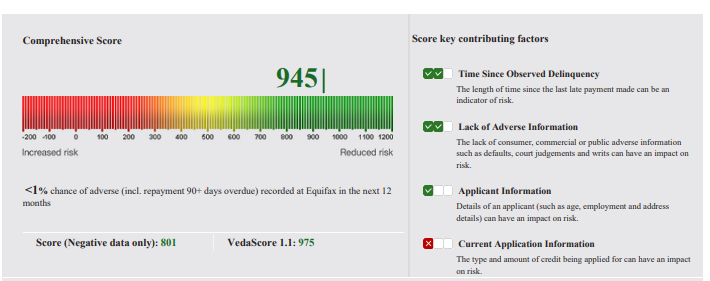

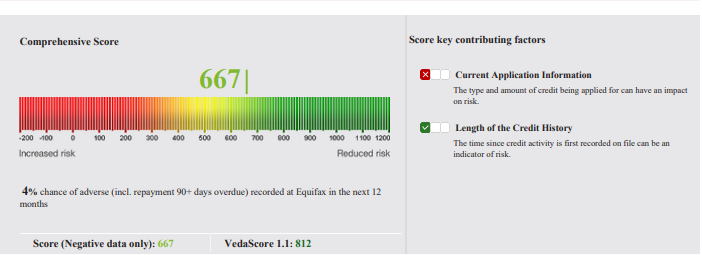

Consider the case of Jordan, who approached us in a state of despair. Jordan was burdened with a default from a major bank that made applying for a mortgage an impossible dream. In less than two weeks upon reaching out to us, Jordan witnessed a financial transformation that many thought was unattainable.

Our team sprang into action early one morning, and before the clock struck 10 am the same day, we had successfully negotiated the removal of the default.

At Australian Credit Solutions, we pride ourselves on our ability to handle any disputable default, big or small, paid or unpaid, with any national bank. Jordan's story is a testament to our commitment.

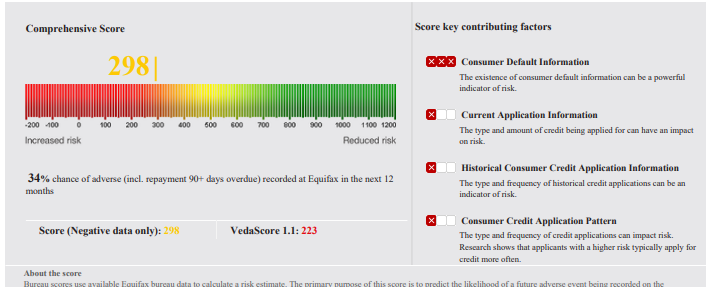

James found himself in a tight spot over a relatively minor default – just a few hundred dollars. It might seem insignificant, but to most reputable lenders, the size of the default hardly matters. It's the fact of the default itself that can tarnish one's financial reputation.

Understanding the urgency, our team sprang into action. In a stellar turnaround of just 48 hours, we were able to secure the removal of James’ financial hiccup. This swift correction meant that James could avoid the trap of extortionate interest rates from less scrupulous lenders.

If credit repair is too stressful and complicated a process for you, we have services best tailored to your situation. These services include but not limited to:

Free Credit AsessmentDefaults are late payments on your credit history list that can decrease your odds of getting a loan.

Court judgments in your credit file indicate high risk and reveal you have agreed without legal intervention because you failed to repay your credit provider.

Invalid Credit Inquiries are unauthorized, made by someone else, or it's added incorrectly on your file.

We know how credit history works and apply our expertise to your situation so that it can accurately manifest your ability to pay back and manage your finances. We will offer you the best services on the best way to obtain funding.

At Australian Credit Solutions, we are dedicated to helping you take control of your financial reputation through expert management of your credit profile. We can assist you in:

We'll help fix any false defaults affecting your score.

Any unwarranted credit inquiries? We'll challenge them for you.

Assistance with addressing and resolving any court judgments that impact your credit.

We'll help dispute and correct any inaccuracies in your repayment history.

Receive a comprehensive breakdown of your credit report to understand and improve your score.

We'll work to resolve issues arising from identity theft that’s affecting your credit.

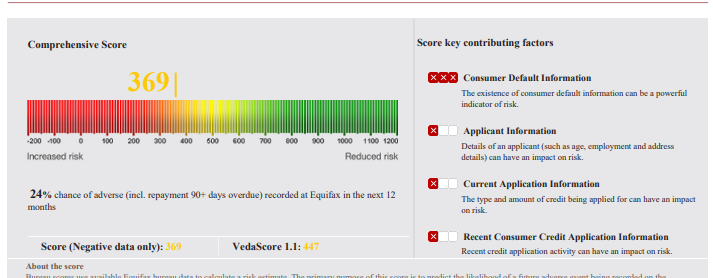

The first step in our credit repair process is to generate a premium credit report. This is the same type of report that banks and other institutions review before approving a loan. By obtaining this comprehensive report, we can identify what might be wrong with your credit file from an institutional perspective.

If you already have a premium credit report, you can provide it to us. If not, we can generate one for you for a small fee of $29.99. We'll guide you through the process over the phone, step by step, ensuring we check the entire report together. Once the report is generated, we send you a copy and review it with you.

Next, we conduct a detailed assessment of your credit report, analyzing each item thoroughly. This review usually costs $299, but for a limited time, we offer a no-obligation, risk-free assessment. During this review, we will go over each point with you over the phone, step by step, ensuring you understand every aspect of your report.

Based on our review, we will advise you if we can take your case forward, estimate how long the process will take, and discuss payment terms. We will only proceed with your case if we are confident in our chances of success, thanks to our No Win No Fee policy (terms and conditions apply). This ensures you are in safe hands throughout the process.

To get started, you can either chat with us live, fill out the form above to schedule a call, or simply call us on our 1300 368 302. We are here to help you take your case forward and improve your credit score.

Our Credit Repair Specialist helps people to fix the issues on their credit file. Our experienced and reliable specialist will answer your inquiries and offer the service best suited for your financial situation.

Verified Client's TestimonialOur Company comprises a dedicated team of professionals well-versed in credit scoring and comprehensive solutions. Our expertise lies in enhancing credit scores and rectifying financial matters. Partnering with us means receiving a personalized credit improvement plan, meticulously crafted to align with your financial objectives. Our strategies are designed to assist you in achieving your funding targets across various regions in Australia.

If you need assistance, kindly get in touch with us today. We will communicate clearly and our dedicated Credit Repair specialist will give your Credit file the attention it deserves to get it back on track

Simply click below to fill out the Credit Assessment form and also Schedule a meeting with our Credit Repair Specialist.

You can get a Free Copy of your Credit File on Equifax website or we can organise a premium report for you.

We’ll give you all the information you need to know where you stand.

If you are looking forward to fixing your credit and getting finance as soon as possible, you may contact us or fill out the form on this page to get started

I feel happy alot thanks heaps I'm so thankful for everything you's have done for me and I really do appreciate it so much thank you so much..