Here are the compelling reasons why Australian Credit Solutions stands out as your preferred choice in the credit management market:

Our confidence in our services is backed by a 'no win no fee' policy. If we are unable to secure a win in your case, we initiate a refund of your fees. Please note that a one-off admin fee of $330 is excluded from this refund policy, but this demonstrates our commitment to providing value and real results for our clients.

We take pride in being the number one award-winning company within our industry. We have a track record of award-winning excellence in 2022, 2023, and 2024. This distinction reflects our unwavering commitment to top-notch service and profound expertise. Each award underscores our credibility and the effective solutions we provide, setting a benchmark for quality and performance in our industry.

Our exceptional services have earned us recognition three times consecutively, emphasizing our commitment to high standards in credit repair and customer satisfaction. Celebrated by Australia's leading review platform, Product Review, we are trusted for our transparent and reliable services. With over 1000 positive client testimonials, our reputation for real results and personalized attention is solidified.

In Australia, all credit repair companies must be licensed under the Australian Securities and Investments Commission (ASIC) and are required to obtain an Australian Credit License (ACL). Australian Credit Solutions proudly holds a valid license, a testament to our legitimacy and adherence to regulatory standards. Our ACL number which is 532003 further establishes our credibility, ensuring that clients can trust us with their credit repair needs, knowing they are in professional and compliant hands.

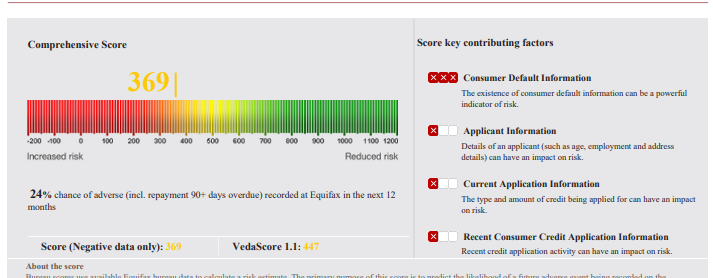

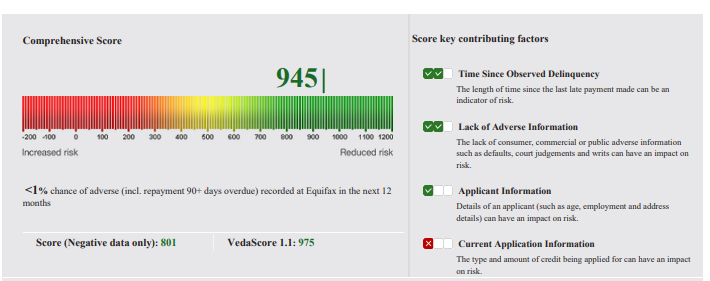

Consider the case of Jordan, who approached us in a state of despair. Jordan was burdened with a default from a major bank that made applying for a mortgage an impossible dream. In less than two weeks upon reaching out to us, Jordan witnessed a financial transformation that many thought was unattainable.

Our team sprang into action early one morning, and before the clock struck 10 am the same day, we had successfully negotiated the removal of the default.

At Australian Credit Solutions, we pride ourselves on our ability to handle any disputable default, big or small, paid or unpaid, with any national bank. Jordan's story is a testament to our commitment.

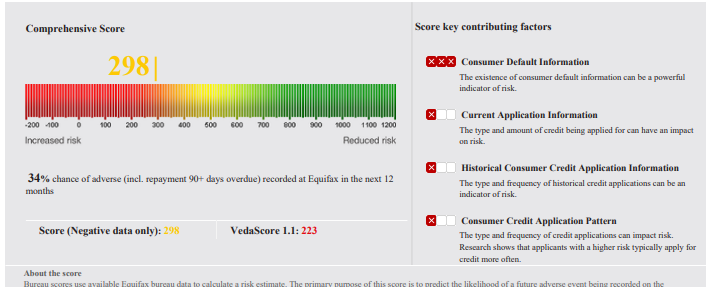

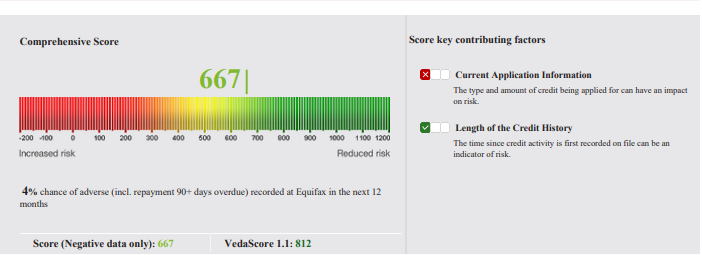

James found himself in a tight spot over a relatively minor default – just a few hundred dollars. It might seem insignificant, but to most reputable lenders, the size of the default hardly matters. It's the fact of the default itself that can tarnish one's financial reputation.

Understanding the urgency, our team sprang into action. In a stellar turnaround of just 48 hours, we were able to secure the removal of James’ financial hiccup. This swift correction meant that James could avoid the trap of extortionate interest rates from less scrupulous lenders.

If credit repair is too stressful and complicated a process for you, we have services best tailored to your situation. These services include but not limited to:

Free Credit AsessmentDefaults are late payments on your credit history list that can decrease your odds of getting a loan.

Court judgments in your credit file indicate high risk and reveal you have agreed without legal intervention because you failed to repay your credit provider.

Invalid Credit Inquiries are unauthorized, made by someone else, or it's added incorrectly on your file.

We know how credit history works and apply our expertise to your situation so that it can accurately manifest your ability to pay back and manage your finances. We will offer you the best services on the best way to obtain funding.

At Australian Credit Solutions, we are dedicated to helping you take control of your financial reputation through expert management of your credit profile. We can assist you in:

We'll help fix any false defaults affecting your score.

Any unwarranted credit inquiries? We'll challenge them for you.

Assistance with addressing and resolving any court judgments that impact your credit.

We'll help dispute and correct any inaccuracies in your repayment history.

Receive a comprehensive breakdown of your credit report to understand and improve your score.

We'll work to resolve issues arising from identity theft that’s affecting your credit.

The first step in our credit repair process is to generate a premium credit report. This is the same type of report that banks and other institutions review before approving a loan. By obtaining this comprehensive report, we can identify what might be wrong with your credit file from an institutional perspective.

If you already have a premium credit report, you can provide it to us. If not, we can generate one for you for a small fee of $29.99. We'll guide you through the process over the phone, step by step, ensuring we check the entire report together. Once the report is generated, we send you a copy and review it with you.

Next, we conduct a detailed assessment of your credit report, analyzing each item thoroughly. This review usually costs $299, but for a limited time, we offer a no-obligation, risk-free assessment. During this review, we will go over each point with you over the phone, step by step, ensuring you understand every aspect of your report.

Based on our review, we will advise you if we can take your case forward, estimate how long the process will take, and discuss payment terms. We will only proceed with your case if we are confident in our chances of success, thanks to our No Win No Fee policy (terms and conditions apply). This ensures you are in safe hands throughout the process.

To get started, you can either chat with us live, fill out the form above to schedule a call, or simply call us on our 1300 368 302. We are here to help you take your case forward and improve your credit score.

Our Credit Repair Specialist helps people to fix the issues on their credit file. Our experienced and reliable specialist will answer your inquiries and offer the service best suited for your financial situation.

Verified Client's TestimonialI'm so grateful didn't think this was possible Harman and Carla cammile have been fantastic in helping me with my business I'm looking forward to you guys..

Perfect! thanks to my consultant Andrew for your work and thanks heaps to Carla Camille for removing my inquiry. you guys are amazing. recommend you and your team to family and friends

I feel happy alot thanks heaps I'm so thankful for everything you's have done for me and I really do appreciate it so much thank you so much..

Great work Dear Gemmalyn, Thanks for helping me realise the stress away Now I can buy my dream..

Great work A big thank you to Bryan for the swift response and updating on the handling of my account..

Perfect Information about my credit Enquiry removal Gemma informed me about my 3 inquiries remival from my file..

I'm so grateful didn't think this was possible Harman and Carla cammile have been fantastic in helping me with my business I'm looking forward to you guys..

Perfect! thanks to my consultant Andrew for your work and thanks heaps to Carla Camille for removing my inquiry. you guys are amazing. recommend you and your team to family and friends

I feel happy alot thanks heaps I'm so thankful for everything you's have done for me and I really do appreciate it so much thank you so much..

Great work Dear Gemmalyn, Thanks for helping me realise the stress away Now I can buy my dream..

Great work A big thank you to Bryan for the swift response and updating on the handling of my account..

Perfect Information about my credit Enquiry removal Gemma informed me about my 3 inquiries remival from my file..

I'm so grateful didn't think this was possible Harman and Carla cammile have been fantastic in helping me with my business I'm looking forward to you guys..

Perfect! thanks to my consultant Andrew for your work and thanks heaps to Carla Camille for removing my inquiry. you guys are amazing. recommend you and your team to family and friends

I'm so blessed to go with you guys I'm very happy with Angie and sky with how they have helped me out I am truly thankful and bless to have you guys thanks so much Angie and sky..

Andrew and Sherylyn are heroes! These guys worked fast and efficiently to achieve this excellent result for me. The whole team was friendly courteous and professional.

So far so good, ladies have .. Relatively easy process and assist me in my goals to having a good credit score, Angie and Gemma have been very helpful..

Amazing Service Received the phone call this afternoon from gai who informed me she had been able to remove the default from my credit file..

Lui has been very helpful and very fantastic. Thank you very much Lui and the rest of the team. Thank you very much Lui for your help in deleting one of my inquiries. I'm so happy and very grateful about the services that I receive from you..

Great job!!! This guys are great 3 weeks into the removal and I see results already so happy about it. Thanks Andrew and Ana for great effort I cant wait to see the end result...

I'm so blessed to go with you guys I'm very happy with Angie and sky with how they have helped me out I am truly thankful and bless to have you guys thanks so much Angie and sky..

Andrew and Sherylyn are heroes! These guys worked fast and efficiently to achieve this excellent result for me. The whole team was friendly courteous and professional.

So far so good, ladies have .. Relatively easy process and assist me in my goals to having a good credit score, Angie and Gemma have been very helpful..

Amazing Service Received the phone call this afternoon from gai who informed me she had been able to remove the default from my credit file..

Lui has been very helpful and very fantastic. Thank you very much Lui and the rest of the team. Thank you very much Lui for your help in deleting one of my inquiries. I'm so happy and very grateful about the services that I receive from you..

Great job!!! This guys are great 3 weeks into the removal and I see results already so happy about it. Thanks Andrew and Ana for great effort I cant wait to see the end result...

I'm so blessed to go with you guys I'm very happy with Angie and sky with how they have helped me out I am truly thankful and bless to have you guys thanks so much Angie and sky..

Andrew and Sherylyn are heroes! These guys worked fast and efficiently to achieve this excellent result for me. The whole team was friendly courteous and professional.

So far so good, ladies have .. Relatively easy process and assist me in my goals to having a good credit score, Angie and Gemma have been very helpful..

Our Company comprises a dedicated team of professionals well-versed in credit scoring and comprehensive solutions. Our expertise lies in enhancing credit scores and rectifying financial matters. Partnering with us means receiving a personalized credit improvement plan, meticulously crafted to align with your financial objectives. Our strategies are designed to assist you in achieving your funding targets across various regions in Australia.

If you need assistance, kindly get in touch with us today. We will communicate clearly and our dedicated Credit Repair specialist will give your Credit file the attention it deserves to get it back on track

Simply click below to fill out the Credit Assessment form and also Schedule a meeting with our Credit Repair Specialist.

You can get a Free Copy of your Credit File on Equifax website or we can organise a premium report for you.

We’ll give you all the information you need to know where you stand.

If you are looking forward to fixing your credit and getting finance as soon as possible, you may contact us or fill out the form on this page to get started

Having negative items on your credit report can feel like a massive roadblock, especially if you're trying to secure a loan, rent an apartment, or even land a new job. The good news is that it is entirely possible to fix bad credit legally by addressing these negative marks head-on. Let’s dive into the practical steps you can take to fix your credit history, improve your credit score, and regain financial confidence.Understanding Bad Marks on Your Credit ReportNegative items are entries on your credit report that reflect poorly on your creditworthiness. These can include:Late paymentsDefaultsBankruptciesCourt judgmentsHard inquiriesUnpaid debts sent to collectionsIn Australia, these records typically stay on your report for varying periods — most often from two to seven years. However, not all hope is lost; there are proven methods to fix your credit score and start moving forward.Steps to Remove Bad Marks from Your Credit ReportStep 1: Get Your Free Credit ReportThe first step to fix bad credit is to obtain a copy of your credit report. In Australia, you're entitled to one free credit report per year from major credit reporting agencies like Equifax, Experian, and illion. Reviewing this report allows you to:Identify any errors or incorrect informationSpot negative items dragging down your credit scoreUnderstand which creditors you need to work with to fix your credit historyStep 2: Identify and Dispute ErrorsErrors on credit reports are more common than you might think. These errors can unfairly damage your credit score. Examples include:Incorrectly reported late paymentsAccounts you never openedDebts that were already paid off but still show as unpaidTo dispute errors, follow these steps:Contact the credit reporting agency: Provide details about the error and any supporting documentation.Reach out to the creditor: Notify them about the inaccuracy and ask them to correct the records.Follow up regularly: Ensure the corrections are processed and reflected in your report.Under Australian law, credit reporting agencies and creditors must correct mistakes without charge, helping you fix your credit score more easily.Step 3: Negotiate with CreditorsIf the negative items are valid — such as a default or late payment — negotiating with your creditors might be an option. This process involves:Requesting a "goodwill deletion": Ask the creditor to remove the negative item, especially if you have a solid repayment history.Arranging a payment plan: If you have outstanding debt, set up a structured plan that works for both you and the creditor.Settling for less than owed: Sometimes, creditors accept a lower payment as a final settlement, but be sure to get the agreement in writing.Australian credit solutions often offer mediation services to help you negotiate effectively and fix your credit history without added stress.Step 4: Add Positive Credit HistoryOne of the most effective ways to fix bad credit is to start adding positive information to your report. Consider the following strategies:Pay all bills on time: Timely payments contribute heavily to your credit score.Take out small credit products: Responsible use of bad credit loans or secured credit cards can build a positive payment history.Limit new credit applications: Too many hard inquiries can lower your score.Using reputable credit repair services can also guide you in choosing the right products to fix your credit score safely and strategically.Step 5: Seek Professional Credit Repair HelpIf the process feels overwhelming, don’t hesitate to seek bad credit help from professionals. Credit repair services can:Review your credit report thoroughlyDispute inaccurate information on your behalfHelp you negotiate with creditorsDevelop a tailored plan to fix your credit historyMake sure to choose a reputable service. Look for Australian credit solutions that follow legal guidelines and provide transparent processes.Step 6: Stay Consistent and PatientCredit repair doesn’t happen overnight. Legally removing negative items and building a positive credit history takes time, but consistency is key. By following the above steps and avoiding future mistakes, you can steadily fix your bad credit.Frequently Asked Questions (FAQs)1. What are negative items on a credit report?Negative items are entries that reflect poorly on your creditworthiness. Common examples include:australiancreditsolutions.com.auLate paymentsDefaultsBankruptciesCourt judgmentsHard inquiriesUnpaid debts sent to collectionsInvestopedia+25Credit Wipe+25Clean Credit+25australiancreditsolutions.com.au+5ACCC+5tippla.com.au+5In Australia, these records typically remain on your report for varying periods, often ranging from two to seven years.2. How can I obtain a copy of my credit report?You're entitled to one free credit report per year from major credit reporting agencies in Australia, such as Equifax, Experian, and illion. Reviewing this report allows you to identify any errors or negative items affecting your credit score.Financial Rights Legal Centre+1NDH+13. What should I do if I find errors on my credit report?If you identify inaccuracies, take the following steps:Contact the credit reporting agency: Provide details about the error and any supporting documentation.Reach out to the creditor: Notify them about the inaccuracy and request a correction.Follow up regularly: Ensure the corrections are processed and reflected in your report.Under Australian law, credit reporting agencies and creditors must correct mistakes without charge.4. Can I negotiate the removal of valid negative items?Yes, negotiating with creditors can sometimes lead to the removal of valid negative items. Consider:Requesting a goodwill deletion: Ask the creditor to remove the negative item, especially if you have a solid repayment history.Arranging a payment plan: Set up a structured plan that works for both you and the creditor.Settling for less than owed: Sometimes, creditors accept a lower payment as a final settlement, but ensure to get the agreement in writing.5. How can I add positive information to my credit report?To build a positive credit history:Pay all bills on time: Timely payments contribute heavily to your credit score.Take out small credit products: Responsible use of bad credit loans or secured credit cards can build a positive payment history.Limit new credit applications: Too many hard inquiries can lower your score.BadCredit.org6. Should I seek professional credit repair assistance?If the process feels overwhelming, consider seeking help from professionals. Reputable credit repair services can:Review your credit report thoroughly.Dispute inaccurate information on your behalf.Help you negotiate with creditors.Develop a tailored plan to improve your credit history.crsolicitors.com.auInvestopedia+2Investopedia+2crsolicitors.com.au+2NDH+2Credit Wipe+2australiancreditsolutions.com.au+2Ensure the service follows legal guidelines and provides transparent processes.7. How long does it take to remove negative items from my credit report?The time frame varies depending on the complexity of the issue and the responsiveness of the involved parties. While some corrections can be made promptly, others may take several weeks. Patience and consistent follow-up are essential.Final ThoughtsRemoving negative items from your credit report legally is not only possible but also essential for your financial well-being. Whether you tackle the process yourself or work with trusted credit repair services, taking action today can lead to a brighter financial future. By carefully managing your credit, disputing inaccuracies, and adding positive records, you’ll be on the fast track to fixing your credit score.If you’re ready to take control of your finances and fix your credit history, start by requesting your free credit report today. Your path to better credit begins now!

The Legal Side of Credit Repair: What You Need To KnowHaving a poor credit score can impact your financial opportunities, from securing a mortgage to getting approved for a credit card. As a result, many people turn to credit repair services to help improve their credit reports. However, credit repair is a highly regulated industry, and understanding the legal aspects can help you avoid scams and protect your rights. In this guide, we’ll walk you through the legal framework surrounding credit repair in Australia, your rights as a consumer, and what you should look for when choosing a credit repair service.Understanding Credit Repair Laws in AustraliaSeveral laws govern credit repair to protect consumers from fraudulent practices and ensure fairness in credit reporting. The primary laws to be aware of include:1. The Privacy Act 1988The Privacy Act 1988 regulates how personal credit information is handled by credit reporting agencies and credit providers. Under this act, credit repair companies must:Ensure accurate and fair handling of credit information.Allow consumers to access their credit reports and dispute incorrect information.Prevent unauthorized disclosure of credit data to third parties.This law is enforced by the Office of the Australian Information Commissioner (OAIC), which oversees compliance and investigates breaches.2. The Australian Consumer Law (ACL)The Australian Consumer Law (ACL) protects consumers from misleading and deceptive conduct by businesses, including credit repair companies. Under ACL, credit repair services must:Provide honest and transparent information about their services.Avoid making false claims about removing accurate negative listings.Ensure that contracts are fair and do not contain hidden fees.The Australian Competition and Consumer Commission (ACCC) and state fair trading agencies enforce these regulations.3. The National Consumer Credit Protection Act 2009 (NCCP Act)The NCCP Act ensures that credit providers operate ethically and responsibly. While it primarily regulates lenders, it also applies to credit repair firms in some aspects, such as:Preventing exploitative practices in the credit industry.Ensuring consumers receive clear and accurate information about financial products.The Australian Securities and Investments Commission (ASIC) enforces this law and takes action against companies that engage in misleading conduct.Your Rights as a ConsumerWhen dealing with credit repair, it’s crucial to understand your legal rights. Here are some key points to keep in mind:You have the right to dispute inaccuracies on your credit report for free, without needing a credit repair service.Credit repair companies cannot guarantee results or promise to remove accurate negative information.You cannot be charged upfront fees for credit repair services.You can report a credit repair company to ASIC, ACCC, or OAIC if they violate the law.If you encounter a credit repair company that violates any of these rights, you can lodge a complaint with the OAIC, ACCC, or ASIC.Common Credit Repair Scams to AvoidUnfortunately, the credit repair industry has its fair share of scams. Here are some red flags to watch out for:1. Companies That Demand Upfront PaymentsLegitimate credit repair companies cannot ask for payment before providing services. If a company requests an upfront fee, it’s likely a scam.2. Promises to Remove Accurate InformationNo credit repair service can legally remove accurate negative items from your credit report. If a company claims otherwise, it is misleading consumers.3. Advising You to Create a New IdentitySome fraudulent services suggest applying for a new credit file using an Australian Business Number (ABN) instead of a Tax File Number (TFN). This practice is illegal and can result in severe penalties, including criminal charges.4. Lack of a Written ContractUnder Australian law, credit repair companies must provide a written contract detailing the services they will provide. If a company refuses to give you a contract, avoid them at all costs.5. Pressuring You to Sign Up QuicklyA reputable credit repair company will give you time to review the contract and understand your rights. High-pressure sales tactics are a major warning sign.How to Repair Credit Legally on Your OwnIf you prefer to repair your credit without hiring a service, here are some legal steps you can take:1. Check Your Credit Report RegularlyObtain free credit reports from Equifax Australia, illion, or Experian and review them for errors or inaccuracies.2. Dispute ErrorsIf you find incorrect information, file a dispute with the credit bureau. You can do this online, by phone, or by mail. The bureau must investigate and respond within 30 days.3. Pay Bills on TimeYour payment history accounts for a significant portion of your credit score. Paying bills on time can significantly improve your credit over time.4. Reduce DebtLowering your credit utilization ratio (the amount of credit you use compared to your credit limit) can boost your score. Aim to keep utilization below 30%.5. Avoid Opening Too Many AccountsApplying for multiple credit cards in a short period can hurt your credit score due to hard inquiries on your report.Choosing a Legitimate Credit Repair ServiceIf you decide to use a credit repair service, ensure they comply with Australian laws. Here’s what to look for:Check their reputation. Look for reviews and complaints with the ACCC, ASIC, and Fair Trading agencies.Ensure they provide a written contract that outlines their services and pricing.Verify their compliance with the Privacy Act and ACL. Legitimate companies will never demand upfront payments.Ask about their dispute process. A reputable company will focus on removing errors, not promising unrealistic results.ConclusionCredit repair is a legitimate process, but it is also an industry filled with potential pitfalls and scams. Understanding Australian credit laws, including the Privacy Act 1988, Australian Consumer Law, and National Consumer Credit Protection Act, will help you protect your rights and make informed decisions. Whether you choose to repair your credit yourself or hire a service, staying informed about the legal side of credit repair ensures that you avoid fraud and improve your financial health the right way.If you’re dealing with credit issues, take control of your credit today by following legal, ethical strategies to improve your score.

Understanding Credit Repair in Australia: Myths vs. FactsCredit repair can often feel like navigating a maze—filled with myths, half-truths, and well-intentioned advice that doesn't quite match reality. If you’ve found yourself wondering if credit repair is the solution to your financial woes, you might be wondering: Are the promises of quick fixes too good to be true, or is there a legitimate way to improve your credit score? The answer lies in understanding the key differences between what’s true and what’s merely a misconception. This blog aims to clear up the confusion surrounding credit repair in Australia by addressing common myths and clarifying essential facts.Myth #1: Paying Off a Debt Automatically Boosts Your Credit ScoreOne of the most common myths around credit repair in Australia is that paying off a debt will magically improve your credit score. Of course, it is true that paying off debt is important to your financial well-being, but it does not automatically translate to a higher credit score. Credit scoring models don't just measure whether you have outstanding debt. They also measure:Credit Utilisation: Even after you pay off a debt, how much of your available credit you’re using remains a factor in your score. If your credit card balance is consistently high, it could negatively affect your score.Credit History Length: If you close an old account after paying it off, you could shorten the length of your credit history, which might hurt your score.Recent Credit Inquiries: If you apply for credit frequently, this can raise red flags with lenders, even if you’ve paid off other debts.Myth #2: Credit Repair Is Only for People with Bad CreditAnother common misconception about credit repair in Australia is that it’s only necessary for people with poor or “bad” credit. While those with a low credit score may be more likely to seek credit repair, it’s equally valuable for anyone who wants to improve their score.If you’ve noticed mistakes on your credit report, even if they don’t drastically affect your score, credit repair services can help clear up these errors. A spotless credit report will put you in a stronger position when applying for future credit, loans, or mortgages.Myth #3: You Can “Pay to Fix Your Credit Score” OvernightMost people wonder whether it is possible to pay some fee to fix your credit in Australia. In reality, the truth is there is no shortcut to having a perfect credit score. Services that promise a fee for a boost in credit score overnight are probably scams.While there are indeed legitimate credit repair agencies in Australia that offer valuable services, they can't perform miracles. No one can remove accurate negative information from your credit report, and it's illegal for credit repair companies to promise such results. The best they can do is assist you in disputing incorrect entries or negotiating with creditors to settle debts or have them removed from your report.It’s important to be cautious of any company that promises to "fix your credit score for a fee," especially if they claim to work outside of the law. In most cases, paying a fee to a credit repair service will not result in an immediate score improvement. Instead, improving your score takes time and a combination of strategic steps, which may include paying off outstanding debts, addressing errors, and making timely payments moving forward.Myth #4: Credit Repair Agencies Can Guarantee ResultsCredit repair agencies can provide valuable help, but they cannot guarantee a specific outcome. There are many factors that influence your credit score—some of which may be outside the control of any credit repair service. For example:Accurate Information: If negative information on your report is accurate (e.g., late payments or defaults), no credit repair agency can legally remove it. It’s crucial to be realistic about the fact that improving your credit score will take time and effort.Consumer Behaviour: Even after you repair your credit, it’s your ongoing financial habits that will determine whether your score remains healthy or falls again. This includes making timely payments, maintaining a low credit utilization rate, and avoiding unnecessary credit inquiries.While no credit repair agency can promise you anything, they will help you to understand how to deal with your credit reports, assist in correcting errors, and negotiate with creditors to eliminate or settle debts. The secret is finding a good agency that's transparent about what they can and can't do.Myth #5: Fixing Your Credit Is All About Removing Negative MarksWhile negative marks like late payments, defaults, and bankruptcies can drag your credit score down, the process of credit repair involves more than just removing these marks. In fact, removing negative marks should be seen as part of a broader strategy. The actual process of credit repair involves:Building a Positive Payment History: One of the most powerful ways to fix your credit score is by showing consistent, on-time payments. Whether it’s a small personal loan or a credit card, paying on time every month builds a positive payment history that outweighs any previous mistakes.Reducing Your Debt-to-Income Ratio: If you have a lot of credit card debt or loans compared to your income, this can hurt your score. By focusing on paying down high-interest debt and improving your debt-to-income ratio, you can improve your creditworthiness.Disputing Errors: Sometimes, your credit report may contain inaccuracies. This could include misreported late payments, incorrect defaults, or even accounts that you never opened. Disputing these errors and having them corrected can have a significant impact on your credit score.Key Facts About Credit Repair in AustraliaThe Role of Credit Repair AgenciesCredit repair agencies in Australia help individuals navigate the complexities of credit reporting. These agencies can assist in identifying inaccuracies in your credit report, disputing errors, and providing advice on improving your financial habits. While they cannot guarantee results, they can help you understand your rights under Australian law and act as a liaison between you and creditors.Timeframe for Credit RepairUnlike the myth of overnight credit repair, it’s important to understand that improving your credit score is a gradual process. Depending on the severity of the issues, it may take months or even years to see a significant improvement in your score. For instance, late payments can stay on your report for up to five years, and defaults can remain for up to seven years. The key is to remain patient and focused on building positive credit habits over time.Legal Removal of Negative MarksIn Australia, some negative marks on your credit report, such as defaults, can be legally removed after a set period of time. If you’ve paid off a debt that was defaulted, the default will be removed after five years, as long as it has been settled. However, if the information is accurate and recent, there’s no way to remove it unless there’s an error or the debt is paid off.Conclusion: The Truth About Credit Repair in AustraliaCredit repair in Australia is not some magical process that will instantly solve your financial situation, but it does represent a real, effective tool to improve one's score for building back healthier credit. By understanding the facts and not falling into common myths, you will have taken the steps necessary to rebuild credit for good. No matter if you decide to do this on your own or seek professional agencies' help, remember that a good credit history is established with proper, consistent financial ways and under the full and proper knowledge of rights.If you want to fix your credit score in Australia, make timely payments, dispute errors, and work with a reliable credit repair service if necessary. All these efforts will pay off in the long run and bring better credit opportunities and financial freedom. Get a free assessment now!

How Does a Young Person Build Credit in Australia?Building a solid credit history is crucial for young adults as it sets the foundation for their financial future. Whether you're planning to buy a home, get a car loan, or simply secure a good interest rate on your credit card, a strong credit score is essential. In this article, we'll explore the best ways for young adults to build credit, using information from RateCity, and ensure your financial health is on the right track. Let's dive into the strategies and tips to help you build credit effectively.Understanding Credit Scores and Their ImportanceBefore we delve into the best ways to build credit, it's important to understand what a credit score is and why it's significant. A credit score is a numerical representation of your creditworthiness, based on your credit history. It ranges from 300 to 850, with higher scores indicating better creditworthiness. In Australia, your credit score can significantly impact your ability to obtain loans, credit cards, and even rental agreements.Importance of Building Credit EarlyBuilding credit early in life can provide numerous benefits. A good credit score opens doors to various financial opportunities and can save you money in the long run. It allows you to qualify for lower interest rates, higher credit limits, and better loan terms. Additionally, landlords and employers often check credit scores to assess your reliability and responsibility. Therefore, starting to build credit as a young adult is a wise financial move.1. Open a Credit CardOne of the simplest ways to start building credit is by opening a credit card. Credit cards are a great tool for establishing a credit history, as long as they are used responsibly. Here are some tips for using a credit card to build credit: Choose the Right Credit Card: Look for a credit card specifically designed for young adults or first-time cardholders. These cards often have lower credit limits and may come with student-friendly benefits. Pay On Time: Always make your payments on time. Late payments can have a negative impact on your credit score. Keep Balances Low: Try to keep your credit card balance below 30% of your credit limit. High balances can hurt your credit score. Avoid Unnecessary Debt: Only use your credit card for essential purchases and avoid accumulating unnecessary debt. By following these guidelines, you can use a credit card to build a positive credit history and improve your credit score.2. Become an Authorized UserAnother effective way to build credit is by becoming an authorized user on someone else's credit card account. This strategy allows you to benefit from the primary cardholder's good credit history. Here's how it works: Choose a Responsible Primary Cardholder: Ask a family member or close friend with good credit to add you as an authorized user on their credit card account. Use the Card Responsibly: Even though you're not the primary cardholder, it's essential to use the card responsibly. Make small purchases and ensure they are paid off on time. Monitor Your Credit: Regularly check your credit report to ensure that the authorized user account is being reported correctly. Being an authorized user can help you establish a credit history and improve your credit score without taking on too much risk.3. Pay Your Bills on TimeTimely bill payments are a crucial factor in building and maintaining a good credit score. This includes not only credit card bills but also utility bills, rent, and any other recurring payments. Late or missed payments can negatively impact your credit score and stay on your credit report for up to seven years.To ensure you never miss a payment, consider setting up automatic payments or reminders. This way, you can maintain a consistent payment history, which is essential for building and improving your credit score.4. Take Out a Small LoanTaking out a small loan, such as a personal loan or a credit-builder loan, can also help you build credit. Here’s how you can make the most of this strategy: Choose a Loan That Reports to Credit Bureaus: Ensure that the loan you take out is reported to the major credit bureaus. This will help establish your credit history. Make Regular Payments: Just like with credit cards, making regular, on-time payments is crucial. This demonstrates your ability to manage debt responsibly. Consider a Credit-Builder Loan: Some financial institutions offer credit-builder loans specifically designed to help individuals build credit. These loans typically hold the borrowed amount in a savings account, which you can access once the loan is paid off. By responsibly managing a small loan, you can build a positive credit history and improve your credit score.5. Monitor Your Credit ReportRegularly monitoring your credit report is essential for maintaining a good credit score. It allows you to identify any errors or inaccuracies that could negatively impact your credit. Here’s what you should do: Obtain a Free Credit Report: In Australia, you are entitled to a free credit report once a year from each of the major credit bureaus. Take advantage of this to review your credit history. Check for Errors: Look for any incorrect information, such as wrong account balances or late payments that you know were paid on time. Dispute any inaccuracies with the credit bureau. Monitor for Identity Theft: Regular monitoring can also help you spot signs of identity theft early, such as unfamiliar accounts or transactions. By keeping an eye on your credit report, you can ensure that your credit history remains accurate and up-to-date.6. Limit Credit InquiriesWhenever you apply for credit, such as a credit card or loan, the lender will perform a credit inquiry. Too many credit inquiries in a short period can negatively impact your credit score. To avoid this, be selective about when and where you apply for credit.7. Use a Secured Credit CardA secured credit card is another excellent tool for building credit, especially if you have no credit history or a low credit score. Here’s how it works: Deposit a Security Amount: With a secured credit card, you deposit a certain amount of money as collateral. This deposit typically becomes your credit limit. Use Responsibly: Use the secured credit card just like a regular credit card. Make small purchases and pay off the balance in full each month. Build Credit History: As you make on-time payments, your credit history will improve, and you may eventually qualify for an unsecured credit card. Secured credit cards are a low-risk way to build credit and demonstrate your creditworthiness to lenders.8. Avoid Closing Old Credit AccountsThe length of your credit history is a factor in your credit score. Therefore, keeping old credit accounts open, even if you no longer use them regularly, can be beneficial. Closing old accounts can shorten your credit history and potentially lower your credit score.9. Consider a Co-SignerIf you're having trouble qualifying for credit on your own, consider asking a family member or friend to co-sign a loan or credit card application. A co-signer with good credit can increase your chances of approval and help you build your credit history. However, it's essential to use this option responsibly, as any missed payments will affect both your credit score and the co-signer's.10. Practice Good Financial HabitsBuilding and maintaining a good credit score requires practicing good financial habits consistently. Here are some additional tips: Budget Wisely: Create a budget to manage your income and expenses effectively. This will help you avoid overspending and ensure you have enough funds to pay your bills on time. Save for Emergencies: Having an emergency fund can prevent you from relying on credit cards or loans in times of financial hardship. Live Within Your Means: Avoid the temptation to spend more than you earn. Living within your means is essential for maintaining financial stability and building a good credit score. 11. Educate Yourself About CreditThe more you know about credit and how it works, the better equipped you will be to make informed financial decisions. Take the time to educate yourself about credit scores, credit reports, and the factors that influence them. Understanding these concepts will help you develop strategies to build and maintain a good credit score.Building Credit in AustraliaFor young adults in Australia, building credit may involve some unique considerations. The Australian credit system has its own nuances, and understanding them can help you navigate the process more effectively. Here are some Australia-specific tips for building credit: Understand Your Credit Report: In Australia, your credit report includes information from several credit reporting agencies. Make sure to obtain your credit report from all major agencies to get a complete picture of your credit history. Utilize Financial Products Wisely: Various financial products, such as personal loans, credit cards, and car loans, can impact your credit score. Use these products wisely to build a positive credit history. Seek Professional Advice: If you're unsure about how to build or improve your credit, consider seeking advice from a financial advisor or credit counselor. They can provide personalized guidance based on your specific situation. Avoiding Common Credit MistakesAs you work towards building your credit, it's important to avoid common mistakes that can negatively impact your credit score. Here are some pitfalls to watch out for: Missing Payments: One of the most significant factors affecting your credit score is your payment history. Missing payments can have a severe negative impact. Maxing Out Credit Cards: Using too much of your available credit can lower your credit score. Aim to keep your credit card balances low. Applying for Too Much Credit: Each credit application results in a hard inquiry on your credit report. Too many inquiries in a short period can hurt your score. Ignoring Your Credit Report: Failing to monitor your credit report can result in undetected errors or fraudulent activity. How Can Australian Credit Solutions Empower Young Adults to Build a Strong Credit Score?Empowering young adults to navigate the financial landscape with confidence is at the heart of what we do at Australian Credit Solutions. Our tailored credit repair and management services are designed to put you firmly on the path to financial success. Here’s how we can help:Comprehensive Credit Report Analysis Identify and Correct Inaccuracies: We dive deep into your credit report, identifying and correcting any inaccuracies, expired records, or inconsistencies that may be impacting your score negatively. Dispute Invalid Records: Our team challenges and disputes invalid inquiries, court judgments, and incorrect defaults, ensuring your credit file reflects your true financial history. Strategic Credit Repair Services Defaults and Judgments: We understand how certain markers on your credit file can significantly hamper your ability to secure loans. By working to remove unwarranted defaults and court judgments, we clear the path to better credit opportunities. Handling Identity Theft: Identity theft can wreak havoc on your credit score. We’re skilled at identifying and fixing issues arising from such theft, safeguarding your financial identity. Tailored Financial Guidance One-on-one Support: Every client is paired with a dedicated credit repair specialist who provides personalized advice and strategies to improve your credit profile. Educational Resources: Gain insights into better financial management and understand the steps you can take independently to continue building your credit score. Why Working With Us Makes a Difference Accuracy and Precision: Our detailed approach ensures every aspect of your credit history is analyzed and optimised for accuracy. Speedy Resolutions: We pride ourselves on our ability to quickly rectify credit issues, often seeing results in less time than expected. Client Testimonials: Verified testimonials from our clients reflect our commitment to excellence and the tangible results we’ve achieved on their behalf. Broad Spectrum of SupportWhether you’re seeking to secure a home loan, finance a car, or simply want to better position yourself financially for the future, Australian Credit Solutions is here to assist. Our comprehensive suite of services is tailored to meet the unique needs of young adults at various stages of their credit journey. Loans and Mortgages: Enhance your likelihood of approval with a clean credit slate. Leasing Opportunities: Improve your credit profile to secure favourable leasing terms. Credit Cards: Reduce overall debt and correct negative items to improve your credit card options. Take the First Step Towards Financial FreedomCommitting to your financial health is a step towards empowering your future. At Australian Credit Scrolls, we're not just fixing numbers on a report; we're setting the foundation for your long-term success. Our bespoke strategies and personal commitment to each client’s situation mean that no matter your starting point, we’re here to guide you to a brighter financial future. Let us help you navigate the complexities of credit repair and management. With Australian Credit Solutions, your journey to improved credit and financial empowerment starts today.

Perfect Information about my credit Enquiry removal Gemma informed me about my 3 inquiries remival from my file..