Building a solid credit history is crucial for young adults as it sets the foundation for their financial future. Whether you're planning to buy a home, get a car loan, or simply secure a good interest rate on your credit card, a strong credit score is essential. In this article, we'll explore the best ways for young adults to build credit, using information from RateCity, and ensure your financial health is on the right track. Let's dive into the strategies and tips to help you build credit effectively.

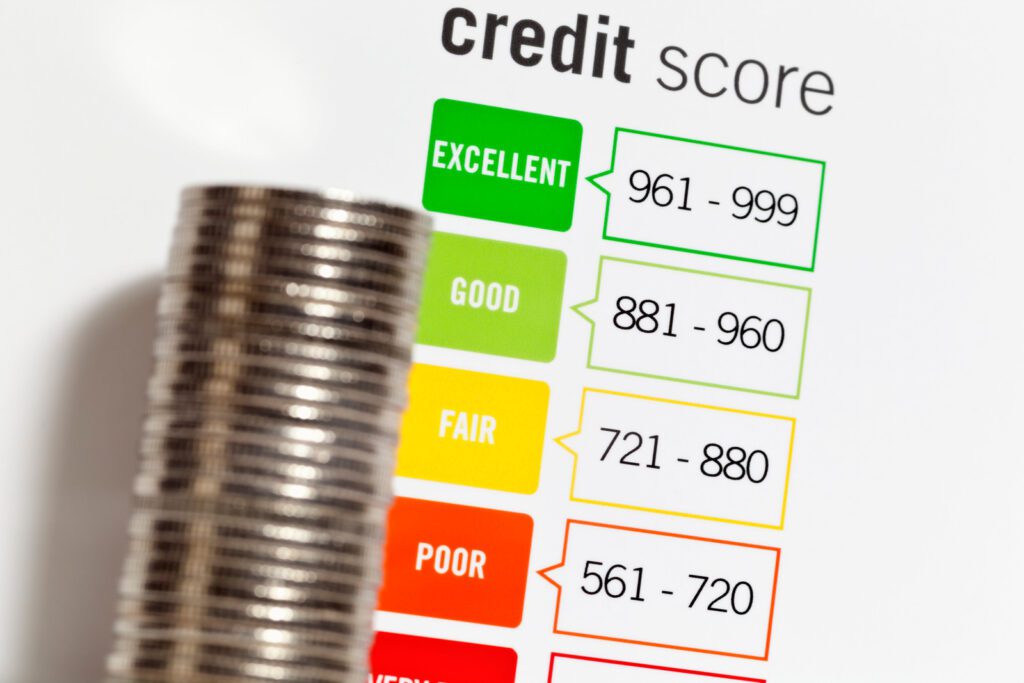

Before we delve into the best ways to build credit, it's important to understand what a credit score is and why it's significant. A credit score is a numerical representation of your creditworthiness, based on your credit history. It ranges from 300 to 850, with higher scores indicating better creditworthiness. In Australia, your credit score can significantly impact your ability to obtain loans, credit cards, and even rental agreements.

Building credit early in life can provide numerous benefits. A good credit score opens doors to various financial opportunities and can save you money in the long run. It allows you to qualify for lower interest rates, higher credit limits, and better loan terms. Additionally, landlords and employers often check credit scores to assess your reliability and responsibility. Therefore, starting to build credit as a young adult is a wise financial move.

One of the simplest ways to start building credit is by opening a credit card. Credit cards are a great tool for establishing a credit history, as long as they are used responsibly. Here are some tips for using a credit card to build credit:

By following these guidelines, you can use a credit card to build a positive credit history and improve your credit score.

Another effective way to build credit is by becoming an authorized user on someone else's credit card account. This strategy allows you to benefit from the primary cardholder's good credit history. Here's how it works:

Being an authorized user can help you establish a credit history and improve your credit score without taking on too much risk.

Timely bill payments are a crucial factor in building and maintaining a good credit score. This includes not only credit card bills but also utility bills, rent, and any other recurring payments. Late or missed payments can negatively impact your credit score and stay on your credit report for up to seven years.

To ensure you never miss a payment, consider setting up automatic payments or reminders. This way, you can maintain a consistent payment history, which is essential for building and improving your credit score.

Taking out a small loan, such as a personal loan or a credit-builder loan, can also help you build credit. Here’s how you can make the most of this strategy:

By responsibly managing a small loan, you can build a positive credit history and improve your credit score.

Regularly monitoring your credit report is essential for maintaining a good credit score. It allows you to identify any errors or inaccuracies that could negatively impact your credit. Here’s what you should do:

By keeping an eye on your credit report, you can ensure that your credit history remains accurate and up-to-date.

Whenever you apply for credit, such as a credit card or loan, the lender will perform a credit inquiry. Too many credit inquiries in a short period can negatively impact your credit score. To avoid this, be selective about when and where you apply for credit.

A secured credit card is another excellent tool for building credit, especially if you have no credit history or a low credit score. Here’s how it works:

Secured credit cards are a low-risk way to build credit and demonstrate your creditworthiness to lenders.

The length of your credit history is a factor in your credit score. Therefore, keeping old credit accounts open, even if you no longer use them regularly, can be beneficial. Closing old accounts can shorten your credit history and potentially lower your credit score.

If you're having trouble qualifying for credit on your own, consider asking a family member or friend to co-sign a loan or credit card application. A co-signer with good credit can increase your chances of approval and help you build your credit history. However, it's essential to use this option responsibly, as any missed payments will affect both your credit score and the co-signer's.

Building and maintaining a good credit score requires practicing good financial habits consistently. Here are some additional tips:

The more you know about credit and how it works, the better equipped you will be to make informed financial decisions. Take the time to educate yourself about credit scores, credit reports, and the factors that influence them. Understanding these concepts will help you develop strategies to build and maintain a good credit score.

For young adults in Australia, building credit may involve some unique considerations. The Australian credit system has its own nuances, and understanding them can help you navigate the process more effectively. Here are some Australia-specific tips for building credit:

As you work towards building your credit, it's important to avoid common mistakes that can negatively impact your credit score. Here are some pitfalls to watch out for:

Empowering young adults to navigate the financial landscape with confidence is at the heart of what we do at Australian Credit Solutions. Our tailored credit repair and management services are designed to put you firmly on the path to financial success. Here’s how we can help:

Whether you’re seeking to secure a home loan, finance a car, or simply want to better position yourself financially for the future, Australian Credit Solutions is here to assist. Our comprehensive suite of services is tailored to meet the unique needs of young adults at various stages of their credit journey.

Committing to your financial health is a step towards empowering your future. At Australian Credit Scrolls, we're not just fixing numbers on a report; we're setting the foundation for your long-term success. Our bespoke strategies and personal commitment to each client’s situation mean that no matter your starting point, we’re here to guide you to a brighter financial future.

Let us help you navigate the complexities of credit repair and management. With Australian Credit Solutions, your journey to improved credit and financial empowerment starts today.

There are several reasons why you should choose Australian Credit Solutions from the many credit repair services available. If you're new to credit repair, we can help review your credit record, identify issues, and create a credit fix strategy tailored for your specific financial situation.

Our team of reliable Credit Solutions can help you identify negative items, fix errors, file disputes, improve your credit score, and get finance. We also provide advice on how to manage your credit and maintain a good credit score so you can stay on top of your finances.

If you need assistance, kindly get in touch with us today. We will communicate clearly and our dedicated Credit Repair specialist will give your Credit file the attention it deserves to get it back on track

Simply click below to fill out the Credit Assessment form and also Schedule a meeting with our Credit Repair Specialist.

You can get a Free Copy of your Credit File on Equifax website or we can organise a premium report for you.

We’ll give you all the information you need to know where you stand.

If you are looking forward to fixing your credit and getting finance as soon as possible, you may contact us or fill out the form on this page to get started